Private Label Courses

Pay To Play

Customizable, gamified financial literacy courses designed to make learning engaging, interactive, and rewarding.

Empower would be homebuyers and investors by turning complex financial concepts into actionable knowledge.

No Time. No Worry.

Stop struggling to find time to personalize advice and build educational content.

Uninformed clients lack process understanding, leading to delays, indecision and blame.

Lost Sales

Without the knowledge to act confidently clients become overwhelmed and walk away.

With industry rules and guidelines constantly changing, it can be a challenge staying up to date.

FSRA

RECO

CMHC

OSFI

BoC

EMPOWER YOUR CLIENTS.

TRANSFORM YOUR BUSINESS.

Increase Conversions:

Stay compliant with the latest regulations and industry updates. When your clients are well informed, they move forward faster, increasing your close rate and driving more sales.

Increase Conversions:

Stay compliant with the latest regulations and industry updates.

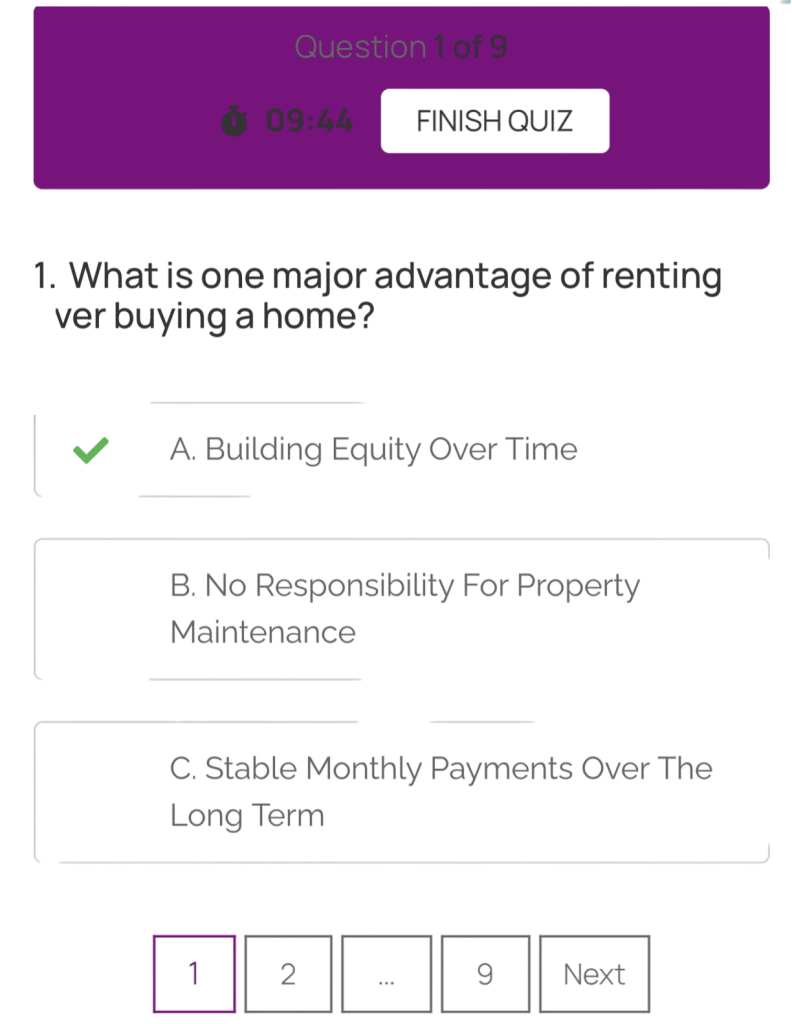

Interactive Quizzes:

Help to reinforce learning and retention by actively engaging clients and providing immediate feedback.

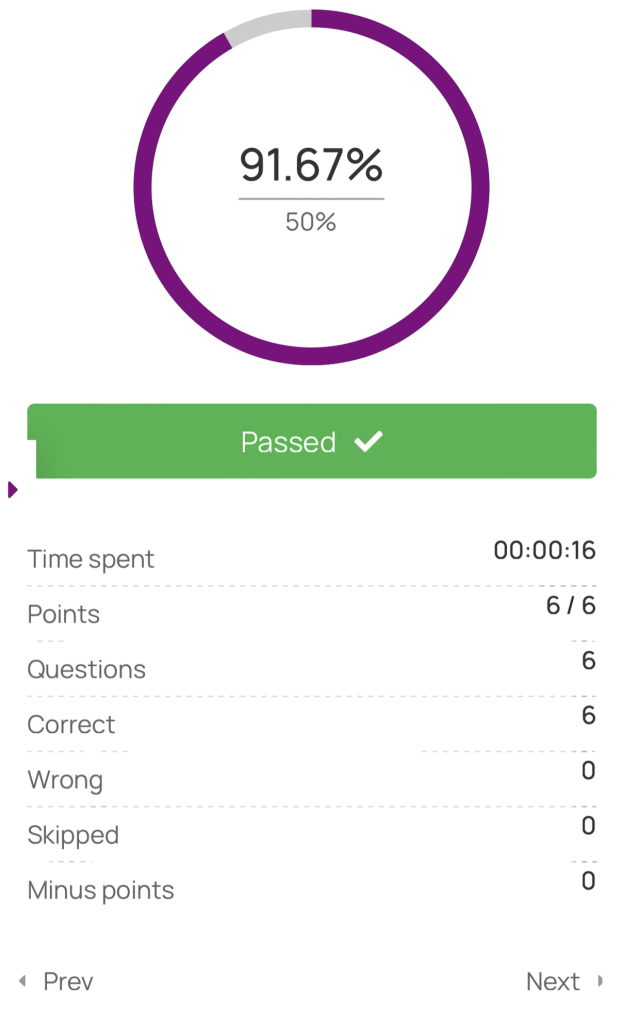

Financial Literacy Made Fun:

Easy-to-understand gamification courses, reward and empower clients to make informed decisions, faster.

Financial Literacy Made Fun:

Easy-to-understand gamification courses, reward and empower clients to make informed decisions, faster.

All In One

Solutions

Offer courses as a paid or complimentary add on service

Set the client rewards you want to give

Appraisals / Inspections

Present Gift Card

Legal fees Cash back

Customize pages with your unique business branding

INSERT YOUR LOGO HERE

Used by financial professionals with years of experience in real estate, mortgages, investment and insurance.

Engage and transform potential clients into actual sales

Lead Generator

Transform your clients' journey and your Sales success.

BOOST YOUR INCOME

CONVENIENCE and FLEXIBILITY

Convenience & Flexibility

STAND OUT

Differentiate Your Brand

BUILD STRONGER RELATIONSHIPS

Win-Win Learning

Elevate Trust with Courses that Matter

Roadmap to Homeownership.

Fun Financial Fitness

Cash and Confetti